Doing nothing is hard to do

‘Don’t just do something; stand there!’.

This delightful piece of wordplay has been around since at least the end of WWII, and has variously been attributed to Clint Eastwood, Dwight Eisenhower, and even Lewis Carroll’s White Rabbit.

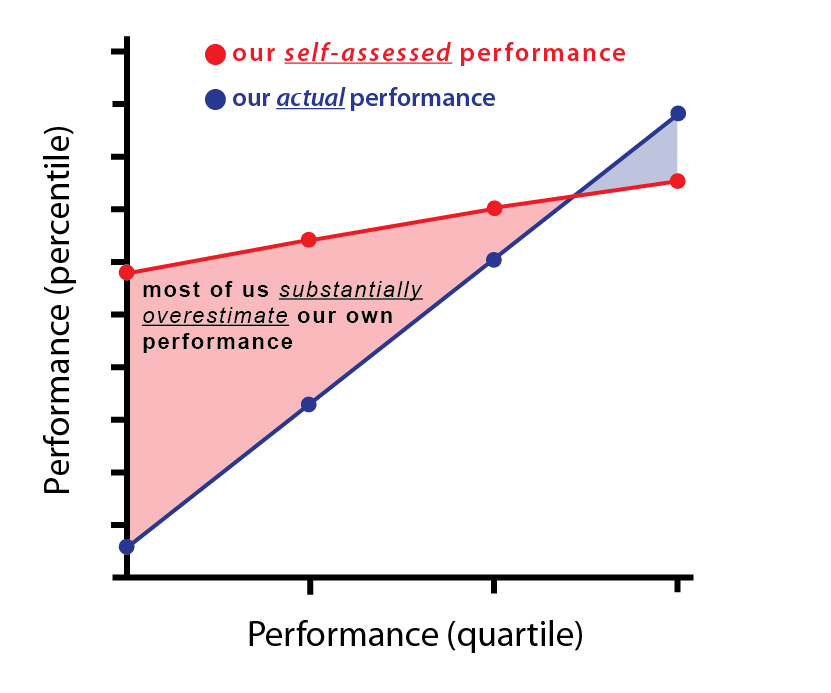

In terms of how this counter-intuitive phrase relates to investing, consider how investors are wont to trade too frequently, thereby often incurring unnecessary transaction costs & capital gains taxes.

To paraphrase Buffett – as seems to be all the rage these days – when there is nothing to be done, do nothing.

Unfashionable can be effective

In one of those sublime, on-point analogies you wish you’d thought of yourself, Tim Mackay of Quantum Financial observed how goalkeepers at the football World Cup might have improved their ratio of penalties saved simply by standing still in the centre of the goal instead of instinctively diving for one of the corners, with penalty takers regularly blasting the ball straight down the middle.

While we often have the urge to do something since it feels as though action must necessarily move us closer to our goals, when it comes to quality investments sometimes inaction can be more effective.

Occasionally, of course, we get investment decisions wrong or the narrative changes, and these assets may need to be sold, but equally a well-planned, long-term investment in any asset class is going to experience summer & winter seasons, and holding on might be the appropriate course of action.

Action/inaction as a positive choice

That doesn’t mean you shouldn’t review your portfolio regularly, and indeed one of the challenges for the value investor is that holdings should be reviewed & benchmarked against new opportunities as they come along.

An independent financial advisor can help you to make such a portfolio decision while considering your goals, structure, asset allocation, & tax position, and how a change of course might impact each of these.

Quantum Financial has an established & proven track record of independence and assisting pre-retirees & retirees, for example, while those at an earlier stage in their journey might consider picking up the phone to Chris Bates at Wealthful.

As with most things in life there is no one-size-fits-all, but do ensure the advisor you engage is independent, and not benefiting unduly from referral fees or commissions.

After all, if you go to someone making their crust from flogging new apartments on behalf of developers for advice (by way of an all-too-common example), what do you think they’re going to recommend for you?