Elite school fees

Each year, our kids are inching closer to high school age, bringing “that conversation” inexorably closer…private schooling.

I didn’t go to a private school (nor did my wife, for that matter), so I’ve generally leaned against the idea, though I can also see that in many cases it could comfortably make for a more attractive option.

A couple of Sydney private schools made headlines earlier this year as their fees rose to a record high of around $46,000 per annum.

Yet despite the high cost of private schooling, it rarely seems to get less popular; if anything, it’s the opposite!

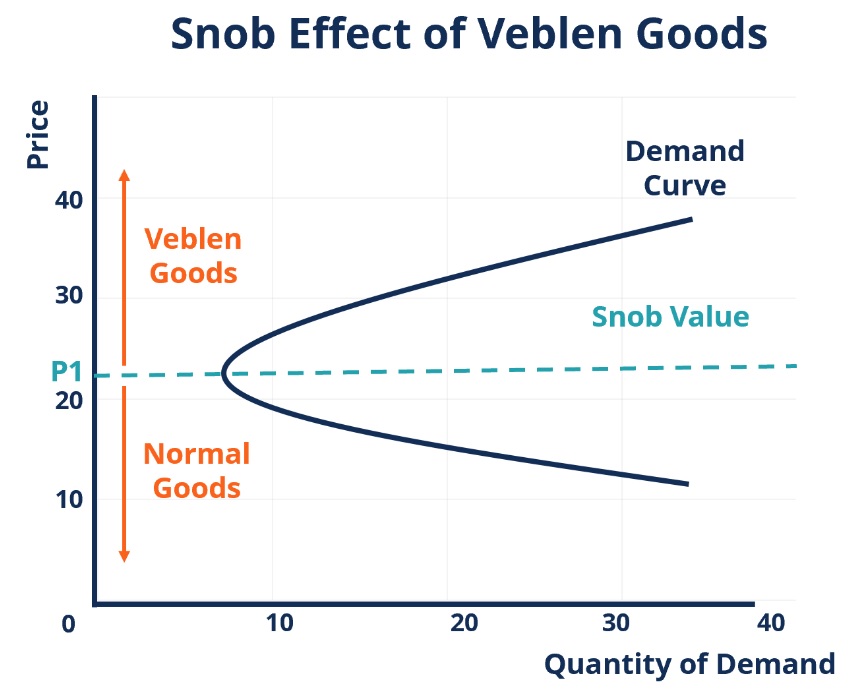

This may partly be because of Sydney’s growing population and changing demographics, but it’s also because elite education can be a Veblen good.

Is the instruction that much better at the top private schools? It’s doubtful.

Or does the higher sticker price itself make the school more attractive?

Defying the laws of supply and demand

In The Theory of the Leisure Class (1899), economist Thorstein Veblen posited that conspicuous consumption was a way of the wealthy displaying status symbols, to signify that they can afford things the average person cannot.

Veblen goods can apparently defy the normal laws of supply and demand, becoming more desirable as the price levitates away from the common consumer.

This explains why a new model of Ferrari can be sold out years in advance, despite the alarming price tag, or why a simple Banksy painting could be sold by Sotheby’s for a seemingly absurd £18.6 million.

High-end housing

There’s nothing new about people saying that Sydney house prices are “crazy”; it’s more or less been a permanent topic of conversation for as long as I can remember, and no doubt long before that too.

Not too long after I was born, in 1979, the Elizabeth Bay mansion Boomerang sold for $1 million, reportedly becoming the first home in Australia to achieve a 7-figure sale.

Today, though, it would likely fetch 100x that figure.

This week a modest 1920s bungalow perched high on the cliffs of Tamarama, Lang Syne, was listed with a price guide of $47 to $52 million, and was sold quick-smart to an advertising guru, comfortably eclipsing the previous suburb record of $29 million.

Conspicuous consumption

Over the past couple of decades I’ve been told (often lectured) by stock analysts with carefully crafted cashflow projections why such prices aren’t sustainable or rational, yet if anything premium prices have seemingly accelerated.

How can the analysts have been so wrong, for so long?

A more useful mental model in such cases would be to consider eastern suburbs homes like these as a Veblen good.

The super-wealthy buyers aren’t looking at discounted cashflows, rental yields, or indeed any relevant metrics of this nature.

Top-end homes in premium markets are bought to signify wealth and status above and beyond what most people can contemplate, and with such housing consumption motivated by the Veblen effect the prices soar up, up, and away.

Especially in a country like Australia, which doesn’t have death duties or punitive inheritance taxes.

I haven’t lived in the east for 15 years, and as a huge convert to the Queensland lifestyle have no intention of returning…but for the sake of my bank balance, let’s hope I can win the private school debate 🙂

Lang Syne, sold this week for $45 million.