Gaper blocked!

I was driving through Fortitude Valley this weekend, at a time of day when there really shouldn’t have been a traffic jam, but the flashing blue & red police lights in the distance foretold a disruptive accident.

Fortunately, I managed to lurk away from the highway down a side-road & skipped most of the queue, resurfacing on the far side of the smash.

As I gratefully pulled away towards home it struck me that the long queue of traffic wasn’t being caused by the accident itself – although it looked as though it might have been a nasty shunt – but by drivers slowing down to have a concerted stickybeak at the aftermath.

Morbid curiosity

Seth Godin has observed that this ‘rubbernecking’ is often undertaken by people that wouldn’t normally dream of going out of their way to look at blood & gore; so what are they hoping or expecting to see?

His theory is that human nature is such we can’t help but take an interest in things that are happening next to us in real time, which causes the traffic to bank up, even when motorists are aware that slowing down will cause congestion for those further back in the queue.

The term ‘rubbernecking’ originated in the US in the late 19th century, & over time began to refer to the tourists on buses craning their necks to take in the sights & sounds of cities such as New York.

The mythical rational profit-seeker

Financial markets do not consist solely of rational, profit-maximising individuals well-trained in long term thinking, as assumed by rational economic models.

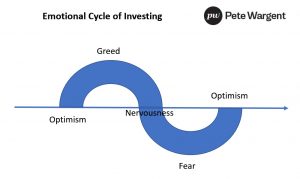

Perhaps more so than ever before, markets are hotbeds of rubbernecking, with participants increasingly consumed by what everyone else is up to, be it states of optimism, greed, nervousness, or fear.

Just like on the tour buses of the early 1900s, many market participants are tourists & ‘out of towners’ having misinformation yelled at them by whichever tour guide or tout has the loudest megaphone.

And it’s not just in the markets themselves that all this goes on: how much time is wasted in online debate over who is ‘right’ and who is ‘wrong’?

As for the tendency towards morbid curiosity, take a look at the commentary the next time that markets are down 5-10 per cent.

Will we hear that asset prices are cheaper, or even on sale, or will the headlines focus on…the horror? Well, let’s see, but I bet you can guess!

For quality assets the long term trend in markets is up, up, up…so as long as you are managing your risk appropriately and your strategy is working, who really cares what everyone else is up to?

On that basis, better to put up your mental incident screen & wind your neck in!